Home insurance in Hawaii protects you against many of the natural disasters which could damage your home or belongings. This insurance also protects you from liability if someone is injured or their property is damaged.

The best homeowners' insurance in Hawaii offers you the coverages and prices you want. Hawaii's unique weather makes it vulnerable to a variety of natural disasters including hurricanes.

They will also give you peace when disaster strikes. They will also help you file your claim quickly, so you can get back to normal as soon as possible.

You can choose additional coverages for your policy. Some policies, for instance, will cover damages caused by an earthquake. Other policies may include increased coverage of landscaping and gardens.

If you own an in-ground pool, it is worth adding to your existing home insurance policy a Pool Owner's Policy. This type of insurance can sometimes save you money over time.

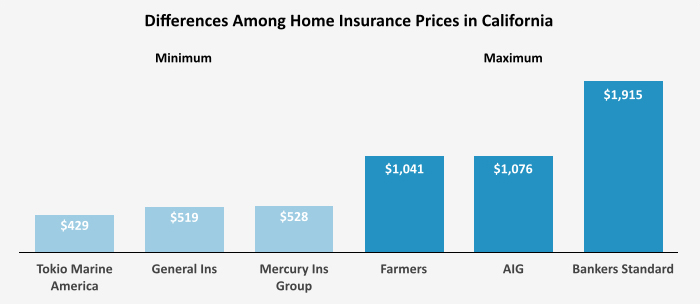

DB Insurance provides the cheapest insurance in Hawaii for houses with pools, at an average annual rate of $286. Also, they offer a discount of 40% when you purchase home and car insurance with them.

State Farm also offers a home insurance policy in hawaii with an average cost of $581. The company is known for its excellent customer service, and they are a good choice for Hawaii residents.

Before making a decision, it's important that you compare rates from several different insurers. It will help you get the best possible price on your policy.

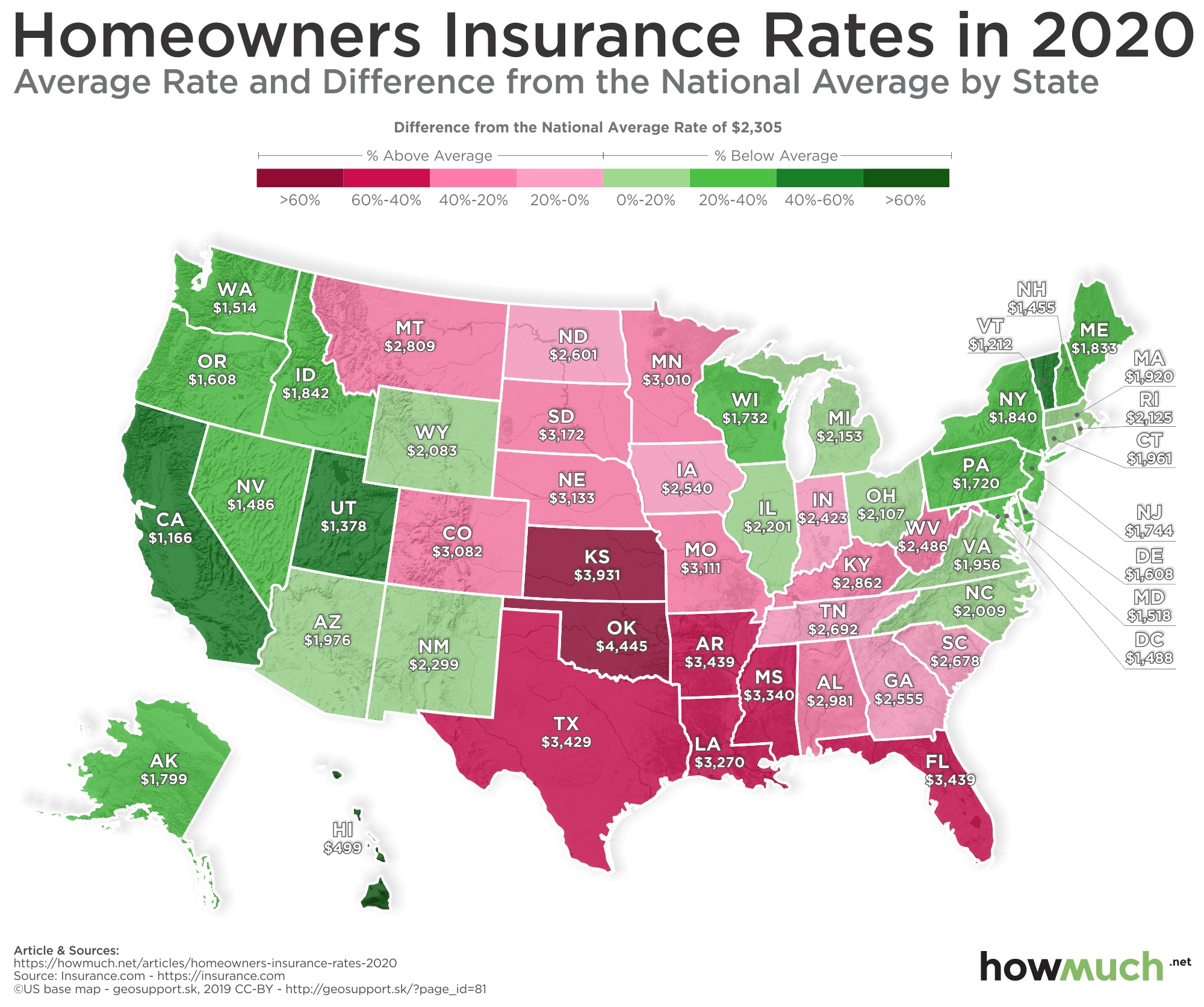

In hawaii, homeowners insurance is not regulated by the state. Therefore, rates may vary between insurers. You should look for companies who have high financial ratings.

You can find out what factors affect the cost of your home insurance policy in Hawaii by looking at your age and where you live. It's a good idea to shop around for the best rates, especially since your risk profile can change over time.

Most insurers will charge higher premiums to those who live in high risk neighborhoods. This could include areas where crime and fire are low. You may also want to consider increasing your deductible in order to reduce your home insurance costs in hawaii.

Make sure that you have flood insurance included in your home policy. This is typically an optional coverage. This coverage may help cover the cost of repairs to your home if it is destroyed by rising waters.

If you are choosing an insurance provider, consider their customer service as well as the history of claims. Great customer service and an impressive claims history can be the difference between finding the best home insurer in Hawaii and being left behind.

For the best homeowners insurance, Hawaii residents should choose an insurance company with strong financial ratings that also offers the features they need. A local company with a wide range of discounts, benefits and offers is a great choice.